Storage quest arises amid hydrogen rush

Explainers

Two underground caverns nearly twice the height of the Eiffel Tower are poised to store enough hydrogen to provide seasonal backup for variable renewable electricity.

The salt caverns, located a two-hour drive south of Salt Lake City, Utah, and owned by Mitsubishi Power America, are part of a network of energy infrastructure set to be operational by 2025. An on-site power plant will be fueled initially by a mix of natural gas and renewable energy hydrogen with a goal of 100% renewable hydrogen by 2045, taking advantage of excess wind and solar energy that may otherwise be wasted.

The caverns will have the capacity to provide 300 gigawatt-hours of storage—100 times the energy lithium-ion batteries stored in the United States in 2021, which would make it the world’s largest source of renewable energy storage, said Michael Ducker, head of hydrogen infrastructure for Mitsubishi.

Mitsubishi Power is one of dozens of companies, state governments and other entities vying for the chance to be part of up to 10 large infrastructure hubs built with government money to make, move and use clean hydrogen in the U.S. Applications were due April 7, and the U.S. Energy Department will make final funding decisions this fall.

Embedded in the hydrogen hub chain is a critical, often overlooked step exemplified in the Utah salt caverns: where and how hydrogen can be stored before it is shipped and piped off for use at factories, fuel stations or power plants.

“Storage is going to be a critical part of the infrastructure if the market is going to grow to the scale envisioned and function efficiently,” Ken Medlock, senior director of the Center for Energy Studies at Rice University’s Baker Institute of Public Policy, told Cipher.

“You will need hydrogen in quantities that are orders of magnitude greater than what is produced now if you are going to decarbonize the industrial and transportation sectors,” he said.

Clean hydrogen can be made either by equipping natural gas plants with carbon capture and storage technology or using renewable or nuclear power to split water molecules into hydrogen and oxygen in a process known as electrolysis.

Hydrogen can be used as a carbon-free fuel to power industries where electrification is not an option (such as steel or concrete production) or as a long-duration storage option, as envisioned by Mitsubishi.

Through tax credits in the 2022 Inflation Reduction Act, the U.S. aims to ramp up clean hydrogen production from less than a million metric tons (mt) today to 10 million mt by 2030 and 50 million mt by 2050, according to the Energy Department’s draft hydrogen strategy.

Storing all that hydrogen—which in its default form is an odorless, colorless gas—will not be easy.

Because of its specific molecular properties, hydrogen must be stored at high pressures as a compressed gas or at extremely sub-zero temperatures (below a frigid -423 degrees Fahrenheit) as a liquid.

Much of the hydrogen produced today is stored in specially designed above-ground tanks or cylinders, and where available, the compressed gas is stored in pipelines and salt caverns (cavities mined from naturally occurring salt domes often used to store natural gas and petroleum).

“Right now, the way we move and store hydrogen on trailers is not scalable,” Naomi Boness, co-managing director of Stanford University’s Precourt Institute of Energy’s Hydrogen Initiative, told Cipher on the sidelines of the CERAWeek by S&P conference in Houston, Texas in early March.

Indeed, the increased demand for storage will likely be met through a combination of methods. Possibilities include some new and existing salt caverns, brine wells (wells drilled into natural salt domes) and new and existing pipelines, along with novel technologies still being developed.

For example, some companies are looking into the possibility of storing hydrogen while transporting it as a chemical derivative, like ammonia and methanol. Others are skeptical of this approach because of the energy expended to transform hydrogen into other substances.

Australian petroleum company Woodside Energy is teaming up with Japanese power companies to explore shipping clean ammonia to Japan, where it would be used as a fuel source. Amogy, a New York-based cleantech startup, is piloting tugboats powered by fuel cells that convert ammonia back into hydrogen.

Other novel approaches include storing hydrogen in hard rock caverns or chemically binding it with certain materials, like metals such as palladium and magnesium.

Like many infrastructure challenges, hydrogen faces a chicken-and-the-egg dilemma.

“There’s not going to be a lot of investment in hydrogen storage until there’s a need” from enough end users, such as manufacturers, said Medlock.

Subsidies for clean hydrogen in the Inflation Reduction Act are designed to help increase such demand from end users.

Until then, the Energy Department recommends hydrogen producers and end-users co-locate their facilities, with above-ground tanks providing sufficient storage for the relatively small volumes produced.

When the federally backed regional hubs start to materialize by the end of this decade, scaled-up storage sites, such as salt caverns and dedicated hydrogen pipelines, will be needed to accommodate the increased volume, the Department said.

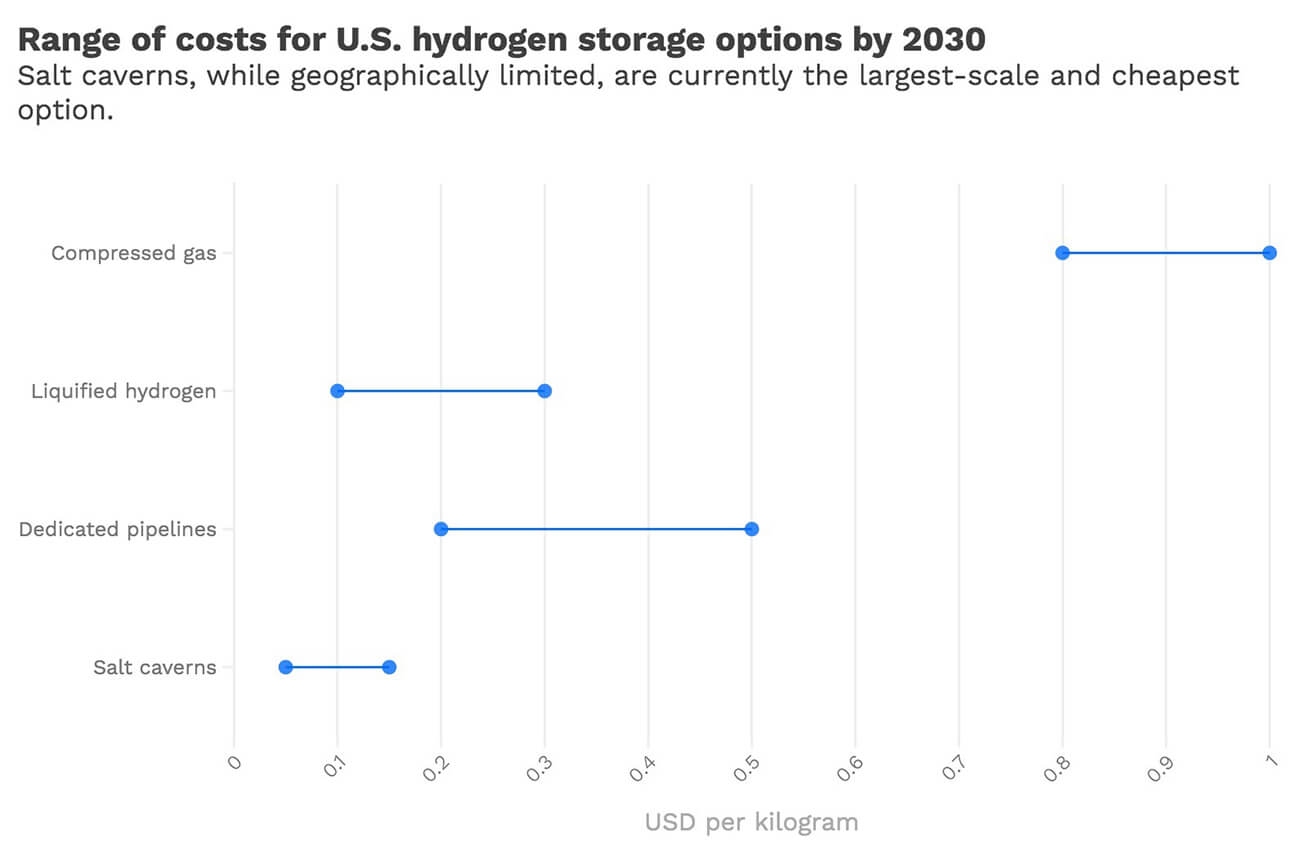

Both options are expensive to develop, however, according to Mona Dajani, head of the hydrogen and ammonia practice at the law firm Shearman & Sterling. What’s more, salt caverns, which the Energy Department finds to be the cheapest option, are limited by geography.

Source: U.S. Department of Energy • Data based on industry figures. Only pipelines include the cost to compress and liquefy hydrogen.

Today, government data shows the 10 million metric tons of hydrogen produced in the U.S., made almost entirely with fossil fuels, are distributed by a network of 1,600 miles of pipeline to chemical and fertilizer plants on the Gulf Coast and in parts of California.

Pipelines can serve a dual purpose of storage and delivery, Boness said.

But siting and permitting pipeline construction often runs into delays and public resistance, said David Edwards, director for hydrogen energy at the industrial gas company Air Liquide USA. Such concerns are likely to grow as the need for hydrogen pipelines grows as well.

Air Liquide owns one of three salt caverns in Texas that currently store fossil fuel hydrogen but could be used for clean hydrogen in the future.

The cavern is linked via pipeline to Air Liquide’s hydrogen production facility in La Porte, Texas, which the company and Energy Department are evaluating for its potential to produce clean hydrogen via carbon capture and storage.

As more industrial customers demand clean hydrogen, the cavern could be used as a potential low-carbon repository, but “that would require a lot of industrial customers to decarbonize,” Edwards said.

Neither Mitsubishi’s Ducker nor Edwards rule out above ground storage, pipelines or other storage options, referring to them as spokes of a hydrogen hub infrastructure. Ultimately though, Ducker said, “we see the lion’s share of hydrogen storage will be subsurface applications.”