Looking back and ahead: climate tech trends in 2021 and 2022

Harder Line

Much like the curve of the Earth you can’t see from the ground, we’ve embarked on a curve in energy and climate history.

Every year since 2018, I’ve looked back and ahead at the trends shaping the year coming to an end and the year ahead.

From this new(ish) perch at Cipher by Breakthrough Energy, my focus is more squarely on the technologies we need to reach net-zero emissions by 2050. With that perspective in mind, let’s keep this annual tradition going!

Five trends in 2021:

1. Net-zero bandwagon

This was the year commitments to reach net-zero emissions went mainstream. Even the most oil-dependent countries (the United Arab Emirates) and major oil companies like BP and Shell have hopped on the bandwagon.

Almost everyone’s doing it, so it must be good, right? Mostly, but we must make sure these commitments are backed up by actual near-term, money-backed tangible commitments from companies and countries. (More on that in a moment.)

2. Record-breaking U.S. federal investments in climate and clean energy tech

The U.S. federal government is keeping the same approach to energy and climate policy that it has in the past: subsidizing clean energy technologies without penalizing fossil fuels.

But this year, it’s supercharging the approach, pouring a record-shattering $100 billion into clean energy research and development with the infrastructure law. And there’s the potential for an eye-popping $500 billion for climate and energy programs in the House-passed Build Back Better Act.

3. Unprecedented venture capital pouring into climate tech

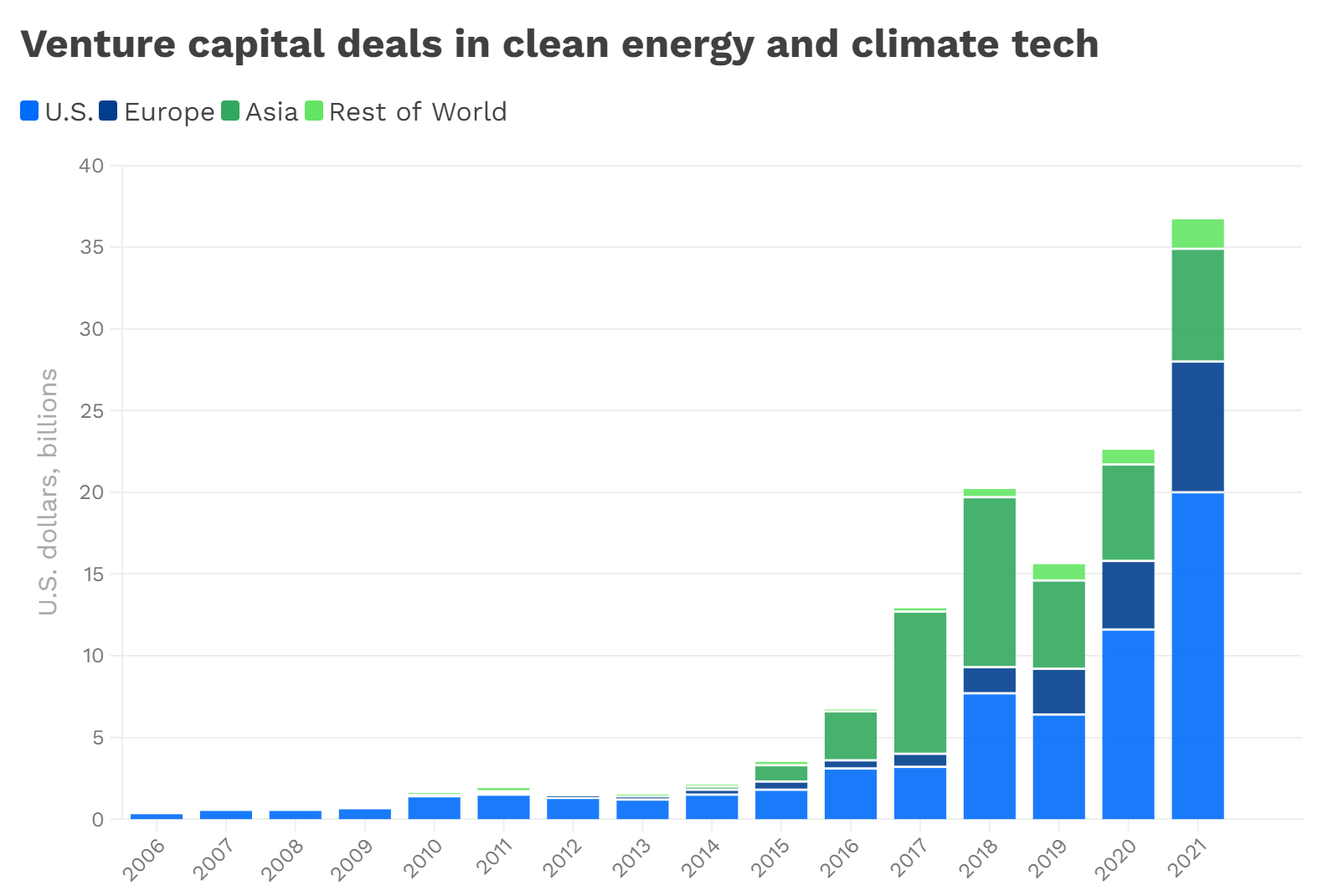

Source: PitchBook, Data complete through November 17, 2021

The cleantech boom of the last decade has nothing on the venture capital money pouring into climate technologies today, according to PitchBook data.

Our inaugural edition of Cipher included exclusive PitchBook data showing historic levels of venture capital investments since the Paris Climate Agreement was signed in 2015.

This latest data has a more comprehensive look, going back further and including both clean energy and climate technology investments.

4. Increased scrutiny of carbon offsets

As investor, activist and political pressures mount for companies to make investment and business plans that actually reduce emissions, the yearslong practice of relying on carbon offsets is facing heightened scrutiny.

Offsets are mechanisms that allow entities to make an investment in one place, like planting a tree or installing a wind farm, that is designed to offset emissions elsewhere.

The whole practice is relatively loosely regulated and managed, so confirming that emissions are reduced is tough. MIT Technology Review and ProPublica pursued a series this year investigating the practice in California and by one nonprofit.

“Some of the offsets are, in my view… flirting with greenwashing, to be honest with you,” said Fatih Birol, executive director of the International Energy Agency, in bonus footage from last week’s Newsmakers interview.

Click here to watch his full comments on offsets.

5. Energy crisis jolts climate debate

This year’s energy crisis isn’t the world’s first, of course. But it is the first since the Paris Climate Agreement was signed in 2015 and the world collectively decided to chart a future with cleaner energy.

Although the causes of this crisis are mostly pandemic-related, you should expect that from here on out, those wanting to forestall progress will cite the clean energy transition as the culprit of high prices.

The thing is, this transition does risk higher fossil fuel prices in the future if not managed well, but that isn’t an argument for not pursuing the transition; it’s an argument for managing it well!

Five trends for 2022:

1. More money, but hopefully not more problems

The Energy Department received nearly $40 billion—a record—for energy research and development in the infrastructure law (DOE gets a total of more than $62 billion in the law).

That’s good news for clean energy innovation, but now it’s facing the Herculean task of getting all the money out the door effectively and fast. First up: Hiring 1,000 new people, the department said last month.

“They have to be very thoughtful about how to structure programs, how to put out money and how they’re going to manage political wins and also when something bad happens with the money invested,” said Spencer Nelson, senior research director at ClearPath, a nonprofit organization focused on clean energy innovation policy.

2. First-of-their-kind projects to the start line

Efforts at both the federal and private-sector level are pouring money into ensuring new technologies can go from invention to commercialization. This could be the year we see a lot of rhetoric turn into action.

The Energy Department’s record funding will help create the supply of new technologies, but we also need demand.

The Biden administration announced the First Movers Coalition at the United Nations climate conference in November, which includes roughly three dozen companies having committed to procure new technologies in such hard-to-clean sectors like aviation and steel.

Closer to Cipher’s home, we’ll be looking at which projects get funding through Breakthrough Energy’s Catalyst program, announced in July.

The program, whose anchor partners span the corporate and government spectrum, will include direct funding for early-commercial projects in sectors that are similarly hard to clean up: sustainable aviation fuels, long-duration energy storage, direct air capture and green hydrogen.

3. Global climate and energy equity

Leaders of developing countries, particularly those in Africa and Southeast Asia, are increasingly speaking out on the importance of ensuring the technological transformation to net-zero emissions by 2050 is equitable.

Although this rift has existed for decades, the topic is taking on greater urgency as multilateral organizations in and run largely by wealthier nations cut off financing for fossil-fuel projects in the developing world (even while they continue such projects within their own borders).

We’ll be looking to see to what degree leniency is granted in some of these restrictions and how development of new clean energy technologies is done in a way that will benefit the entire world, not just the wealthier countries where they’re being invented.

4. Whether the VC market cools down

What goes up, must come down, or maybe not judging by Tesla’s share price. We’ll be looking to see if there is any cooling-off of the red-hot (or should that be green-hot?) climate tech VC space, as noted earlier.

5. Reckoning with clean energy criticism

As we enter the supercharged period of ramping up cleaner energy resources, concerns about their footprints on Earth are rising, including:

- appropriately handling retired wind turbines and other clean energy technologies;

- safely mining for clean energy minerals we need for these technologies;

- streamlining the permitting process for new wind and solar farms and power lines without bulldozing over community rights; and

- ensuring new industrial facilities (hydrogen and carbon capture) are built with environmental justice in mind.

Expect to see these concerns get louder going forward.

The only things that don’t face opposition are things that don’t matter. Everything that matters will, so we should be prepared to have constructive (not destructive) conversations about them.