How Europe uses natural gas and what needs to change

Explainers

Natural gas—particularly Russian gas—has been a source of anxiety for European Union leaders over the last several months as they scramble to find solutions in case Moscow, the bloc’s biggest gas supplier, decides to shut off the tap.

Russia’s invasion of Ukraine has prompted an unthinkable U-turn in the EU’s energy relations with its eastern neighbor: The European Commission is unveiling today a plan—dubbed REPowerEU—aimed at helping the 27-nation bloc shed Russian gas for good over the next five years by accelerating the uptake of renewables and supporting other alternative energy sources.

Two data points help clarify things: how dominant natural gas is in a given energy mix and how dependent that mix is on imports (specifically Russian imports), which indicate vulnerability to a supply disruption.

The higher both data points are, the more risk Russia’s gas dominance poses.

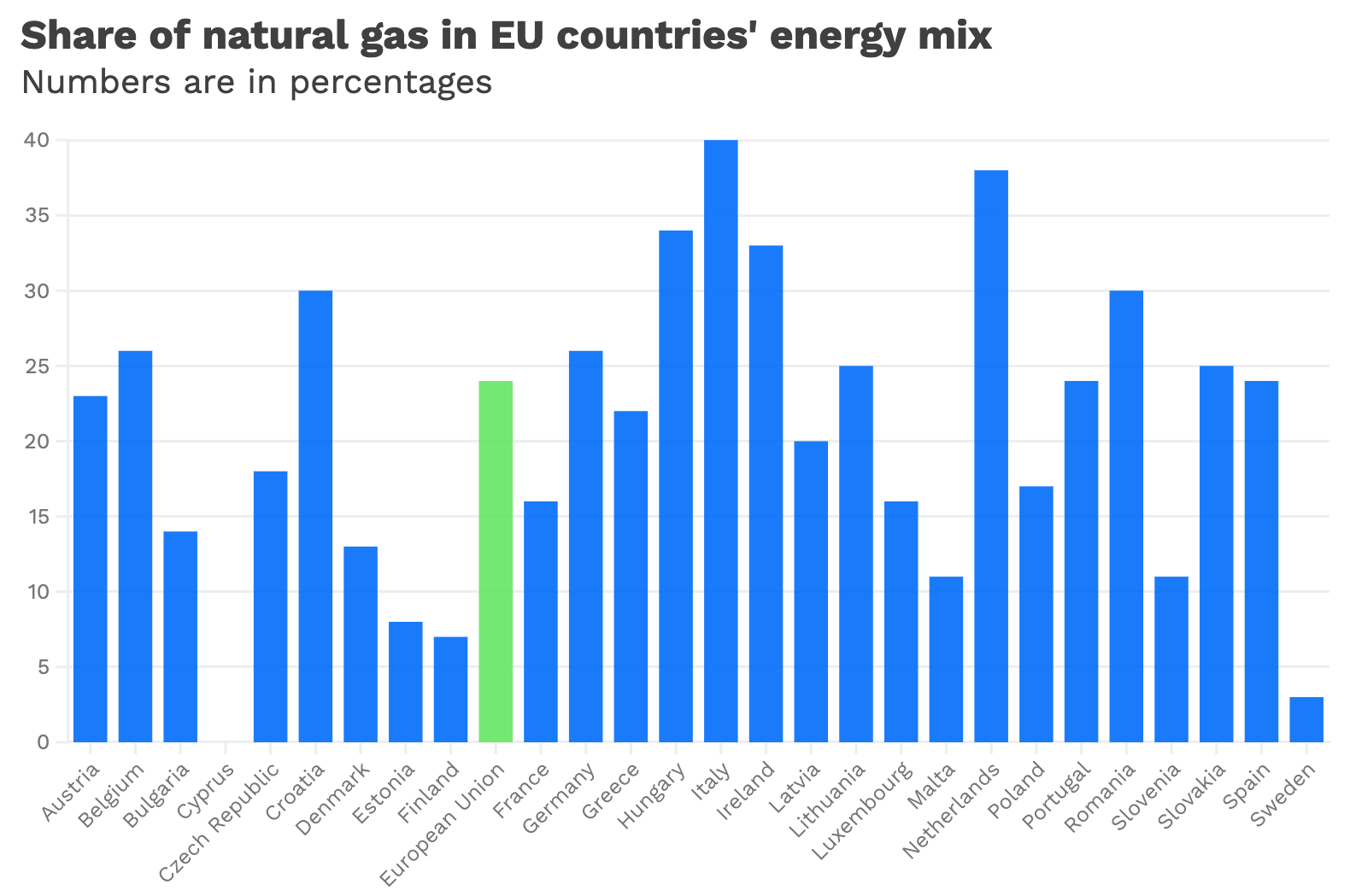

The EU’s decision to wean itself off Russian gas—and natural gas in general—will be an easy task for some member countries and a tough challenge for others due to widely diverse energy mixes and dependencies.

Let’s first look at those two data points for the EU writ large.

Natural gas represents almost 24% of the EU’s total energy mix, accounting for a quarter of the bloc’s greenhouse gas emissions in 2020. (See Data Dive for country-level specifics.)

The bloc imported 84% of the natural gas it needed in 2020, and Russia provided about 40% of that total. The rest came from other suppliers, including Norway, Algeria, Qatar and the United States.

Most natural gas is used by households, in industrial processes and to produce electricity and heat. (See chart below.)

Source: Eurostat, Eurogas, Bruegel • Primary consumption measures total domestic energy demand, while final consumption refers to what end users actually consume. Original unit of measurement is in terawatt hours.

Industry uses natural gas mostly for chemical and petrochemical sectors, and to make aluminum and steel.

At the residential level, millions of Europeans rely on natural gas for heating and cooking. On average, gas provided 40% of space heating, 40% of water heating and 30% of energy used for cooking in the EU’s households in 2019, according to the EU’s official statistical body Eurostat.

Those numbers diverge widely at the country level. For example, 96% of the gas used in households in Greece goes to space heating, 85% in Belgium, 59% in Romania and only 3% in Portugal.

Let’s look at the aforementioned two data points of natural gas share of the energy mix and gas imports for Germany versus Belgium.

Natural gas covers 26% of Germany’s energy mix, and 89% of that is imported—with more than half of that coming from Russia.

In Belgium, gas also makes up 26% of the energy mix and all of it is imported, but only about 3.5% comes from Russia.

This juxtaposition shows Germany would be in a bind if Russia cuts off its gas exports, but Belgium would be mostly unaffected. News reports earlier this month indicated German officials are preparing for a worse-case scenario.

Estonia and Finland import all the gas they need from Russia, yet the fuel only represents 8% and 7% respectively of their energy mix.

Energy systems in Scandinavian countries are generally more electrified than other parts of Europe, mostly due to an abundance and faster uptake of renewable energy. The EU’s average gas consumption is as much as tenfold the electricity consumption of Nordic countries, according to Finnish energy company Fortum.

The European Commission, together with the capitals most vulnerable to a disruption, have secured contracts from global suppliers like the United States and Gulf countries that could help ease the blow in case of a full disruption. Diversifying energy imports is also a key pillar of the REPowerEU plan.

Former EU policy officials have argued that finding alternative gas supplies and building more gas infrastructure will slow down the incentive to use the crisis as a trampoline towards a cleaner future and put the EU’s climate goals at risk.

Commission plans do include increasing the share of cleaner alternatives, such as renewable hydrogen, boosting the EU’s renewable energy and energy savings goals and making permitting for renewable projects easier.

A report out this week commissioned by Breakthrough Energy argues the EU this decade needs to spend the equivalent of what it would on oil and gas (€800 billion, or $842.7 billion) to add more grid infrastructure for renewables, long-duration storage, clean hydrogen and sustainable aviation fuel to achieve that goal.

Another report earlier this month from NGO Climate Action Network Europe found that clear targets for better insulating homes, installing energy-efficient heat pumps in homes and adding more solar PV rooftops can help the bloc ditch Russian gas without increasing its import dependency on other countries by 2025.

These are all for the medium term, however.

In the short term, the EU’s most powerful protection—and probably the less enticing one—is to simply save energy and curb demand. Both the European Commission and the International Energy Agency are encouraging consumers to us less energy as a key point in reducing reliance on Russian gas.

The Italian government, for example, recently decided to ramp up contingency plans: It will force the air conditioning in public buildings like schools and government ministries to be turned down this summer, while also setting a limit to the heating systems for next winter.

Editor’s note: Breakthrough Energy supports Cipher.

Bonus: How natural gas fits into Europe’s energy mix

Source: Eurostat