Fusion power takes a commercial turn

Latest News

DEVENS, Mass. — In a wooded enclave an hour’s drive from Boston, there’s a cavernous building with a large, circular hole cut into the sprawling concrete floor. That’s where the fusion reactor will go.

Across the 47-acre campus, hard-helmeted workers oversee machines coiling thousands of meters of superconducting metallic ribbon. These ribbons will be carefully arranged to form the heart of the reactor. Within it, a glob of matter heated to around 150 million degrees Celsius — more than 10 times hotter than the sun — will produce energy. If the machine works, it will produce more energy than it takes to keep the reaction going.

This energy would be generated without producing greenhouse gas emissions.

I’ve visited dozens of factories and construction sites in three decades as a reporter — a potato chip plant in Iraq, a milk production facility in India, a car factory in Japan and a solar panel manufacturer in Texas. The facility in Massachusetts is something else altogether.

Commonwealth Fusion Systems, the company behind this reactor, wants to set the world’s energy system on a new trajectory toward a future of limitless clean energy. Here in Devens, those lofty aspirations are meeting the real-world challenges of building a commercial power plant.

The company is a well-funded startup whose financial backers include Bill Gates’ Breakthrough Energy Ventures (BEV is a program of Breakthrough Energy, which also supports Cipher). It is among a handful of companies trying to turn fusion not just into a reality, but into viable businesses. Their efforts are backed by government support around the world. Others in the space include Helion Energy, TAE Technologies, General Fusion, Avalanche Fusion, Zap Energy, nT-Tao and UK Industrial Fusion Solutions.

Fusion takes place naturally and constantly across the universe in stars like our sun. Staggeringly high temperatures and intense pressure cause atomic particles to smash together, generating fantastical amounts of energy as they fuse. Making that happen on Earth is hard. Harder still is doing it continuously and cost effectively, the key to commercializing the technology.

Existing nuclear power plants rely on a different reaction known as nuclear fission, where atoms are split apart. That process creates hazardous radioactive waste and without careful control can result in a self-sustaining, destructive runaway reaction. Fusion reactions, in contrast, cannot become self-sustaining and don’t produce radioactive waste.

In recent years, researchers in an experimental lab have generated more energy from a fusion reaction than they put into it — a major scientific breakthrough. The method they used can’t be practically commercialized, though.

Some attempts at commercial fusion are modifying that method — which uses high-powered lasers — while others have opted for different methods. Commonwealth will deploy special electro-magnets — what they call their “special sauce” — to enable a reactor the company is betting will be less expensive to construct and operate.

Commonwealth aims to switch on its reactor, dubbed SPARC, in 2026. The device is being built to demonstrate a fusion reaction can be sustained in a commercially viable way. A larger reactor would then be built to begin generating commercial power in about a decade, the company says.

“You can’t jump straight to the commercial,” said Bob Mumgaard, chief executive and a founder of the company. “But compared to the laboratory, SPARC is delivered in a much more manufactured way. It’s got things that before were made in a high-end, tinkered way but now are replaced with an off-the-shelf thing from a large supplier.”

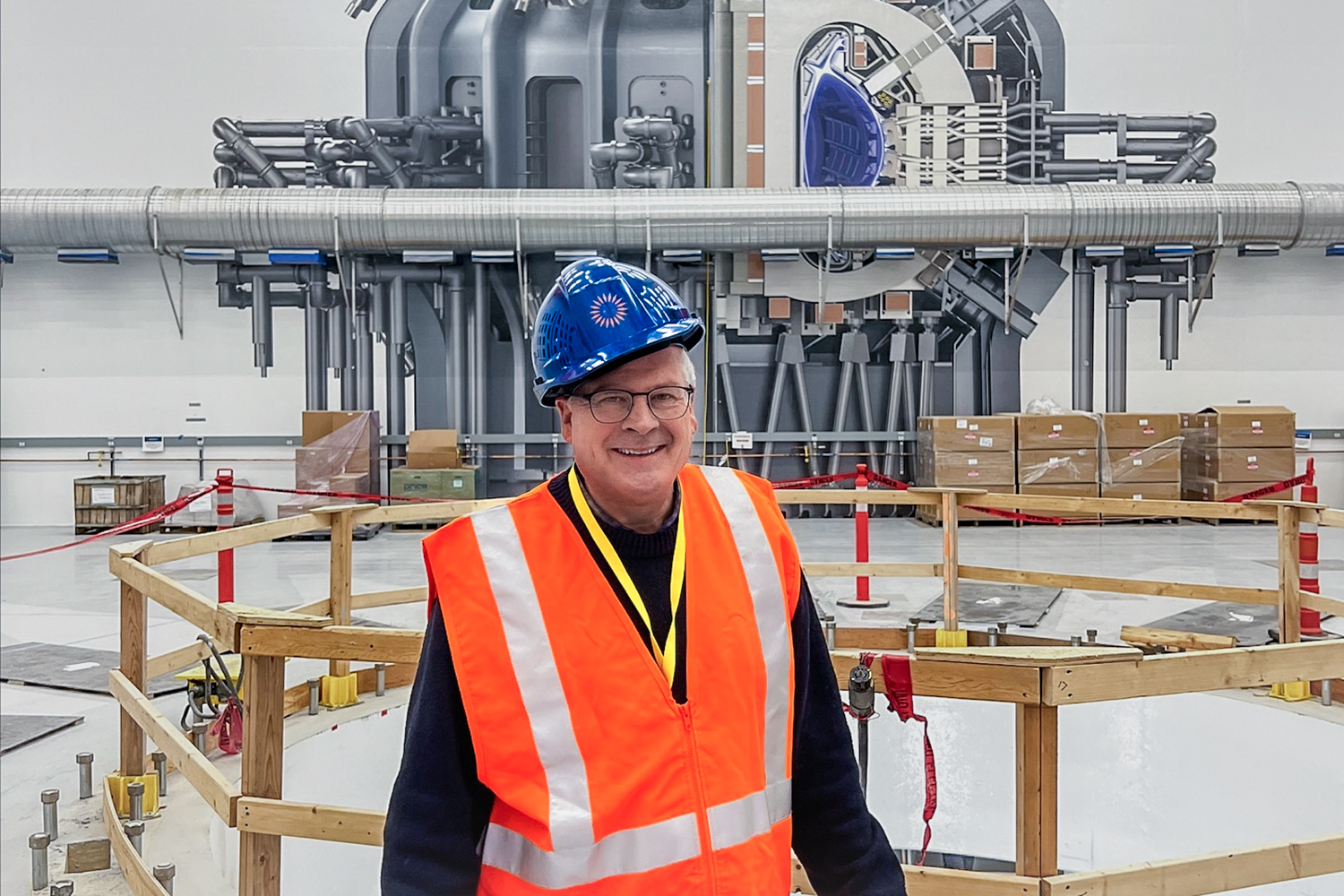

Safety first! Bill Spindle visits the facility Commonwealth Fusion Systems is building for its fusion reactor in Devens, MA. Photo by Bill Spindle.

Commonwealth is part of a burgeoning global industry. At the United Nations climate summit in Dubai in December, fusion was on the docket for the first time. Several countries, including the United States, the European Union, China and India, are working together to build the world’s largest fusion device in France. And forty three companies in a dozen countries are pursuing fusion in various ways, many aiming to supply parts and services to fusion companies.

So far, the commercial industry has received $6 billion in investment, according to the Washington D.C.-based Fusion Industry Association. Developers spent $500 million on fusion supply chains in 2022; that amount is expected to grow to over $7 billion in the next few years and potentially into the trillions of dollars as the industry matures a decade from now, the group said.

“Our target is commercialized fusion,” Daisuke Nakahara, the head of corporate design at Kyoto Fusioneering, told me last June in Japan, where a cluster of fusion companies has developed. Other clusters have sprung up in the U.S., the United Kingdom, the EU and Israel.

Kyoto Fusioneering makes components that manage the intense heat in fusion reactors. Other suppliers make high-powered magnets, lasers and the systems that control them, semiconductors and fuel for the reactions. Others provide services to advise on regulation and influence government policy.

The U.S. Energy Department is also keen to prove the viability of a power source often called the ‘holy grail’ of energy technology. The fusion industry got a boost when the U.S. government chose last year to regulate it under a regime governing nuclear research and medical devices, rather than under the lengthy oversight process for nuclear fission.

Some scientists are skeptical fusion can be commercially viable or that it will be viable quickly enough to play a significant role in the energy transition. They also warn safety and security issues could arise as the technology pushes toward commercialization.

Commonwealth’s Mumgaard and others working to build the industry say creating any new industry, particularly one as complicated as fusion, will face difficulties. They say the challenges can be overcome and risks can be mitigated and managed safely, as with other energy sources.

Mumgaard compares the task ahead to what SpaceX, Elon Musk’s rocketry company, has accomplished for space missions. NASA had long known how to make rockets and explore space. SpaceX figured out how to do it profitably, by standardizing supply chains around reusable rockets.

“We hired a bunch of people from SpaceX,” he told me after my tour.

Investors in Commonwealth Fusion Systems and Zap Energy include Breakthrough Energy Ventures, a program of Breakthrough Energy, which also supports Cipher. Bill Gates, founder of Breakthrough Energy, is also individually invested in Commonwealth Fusion.